Switzerland is considered a so-called third country, as it is not part of the European Union. Therefore, all goods imported into Switzerland must also be declared under customs law. It is not important whether sales are made with the goods in the packages: Press packages, samples, etc. are also considered commercial goods and must be subjected to all customs clearance formalities.

To show your company how cross-border logistics to a non-EU country - Switzerland to be precise - works, Warehousing1 has put together this blog post for you. This way, you can easily get an overview of all the necessary steps for exporting to Switzerland.

You might also be interested in: What effects the Brexit has on eCommerce and your company from January 2021 onwards

When do customs formalities apply?

Under the following conditions, you can export packages and parcels to a third country in the EU without having to go through extensive customs formalities:

- The goods are not intended for commercial purposes or have a value of less than €1,000.

- You do not apply for an export refund (e.g. for agricultural goods).

- According to the foreign trade law no export license is required.

- The shipment contains goods for which no application for remission or refund of import duties is to be made upon re-export. This regulation applies if the duties have been overpaid or had been set too high in the first place.

Tax liability in Swiss mail order business

As a general rule, no import tax is levied on shipments of goods to Switzerland if the import tax amounts to less than CHF 5. However, if your company - which does not have a location in Switzerland - exceeds the turnover limit of CHF 100,000 annually through such small shipments, it will also be subject to tax according to the Swiss Federal Tax Administration .

As soon as your company becomes liable to tax in Switzerland, you assume the role of the importer and must also pay the import tax in Switzerland. You can declare this as input tax in your Swiss tax declaration. To guarantee that all customs formalities can be handled correctly, you must pay attention to the following points:

✔ Are you on the list of taxable mail order companies at the Federal Tax Administration?

✔ Have you clearly marked your mail items? You can read below exactly which documents you must enclose with your consignment of goods.

✔ Have you already informed your shipping partner or fulfillment service provider that the Swiss mail order regulation applies?

Checklist: The following documents must be enclosed with a letter containing goods or a parcel to Switzerland

- Customs declaration of contents

- Commercial invoice

- Export declaration (if the value of the goods exceeds € 1,000)

Details on the individual documents can be found here:

1. Customs declaration of contents

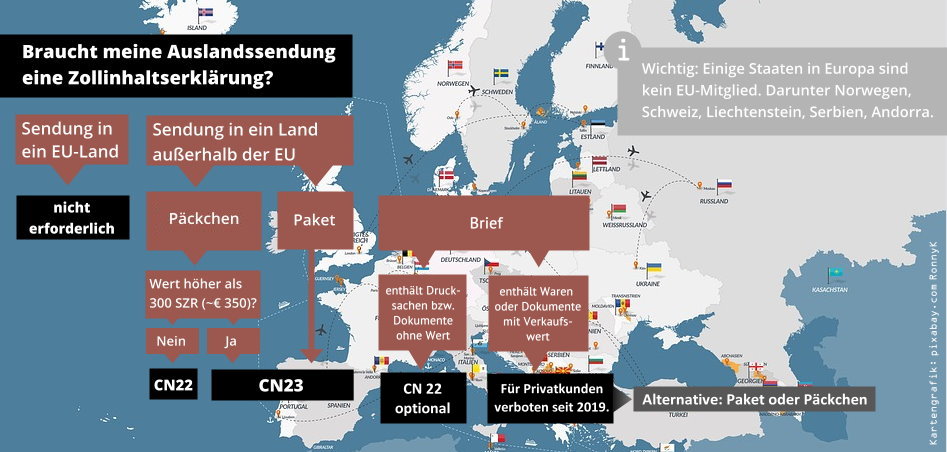

If you are sending a letter or a parcel to Switzerland, the customs declaration CN22 applies. The only condition is that the value of the goods must be less than 300 SDR (Special Drawing Right of the IMF, note: no own currency), which is approximately equivalent to € 350. If the value of goods exceeds this value, form CN23 must be attached.

For parcels, you must always use the customs declaration CN23 - regardless of the value of the goods. If the value of goods exceeds €1,000, an electronic export declaration must be submitted in addition to the CN23.

You can find the individual specifics compared once again here:

Source: Paketda (https://www.paketda.de/ausland/zollinhaltserklaerung.php)

2. Commercial invoice

Please note: The commercial invoice must be attached to the outside of the box. So do not pack it inside the shipment.

In order for customs officials to quickly identify and remove your invoice, you must attach it to the outside of the package in a transparent adhesive sleeve (a shipping bag). If the commercial invoice is inside the package and it has to be opened, you will have to pay an additional handling fee. Also note that shipping costs must be included on the commercial invoice. This is because the shipping costs are also subject to customs clearance.

You can only make the exported goods subject to VAT in Germany if you can prove that they were exported. This is done by means of a so-called "export certificate for VAT purposes", which the usual shipping service providers offer as an additional service. Regardless of whether you are a foreign company selling to commercial customers or private individuals in Switzerland, the rule is that the recipient in Switzerland is responsible for customs duty and Swiss VAT if you can provide proof of an export certificate.

3. Export declaration

Before you can send goods to Switzerland, you must declare them at the export customs office responsible for your location. In Germany, this process is handled electronically via the IT system ATLAS-Export. A service provider can also handle the customs formalities on behalf of your company.

You will receive the so-called export accompanying document (ABD in German). Make sure that you place this as the top document in the shipping bag of the parcel. Next to the recipient's address, affix a yellow adhesive label with the words "Attention! Export declaration", which you can purchase on the Deutsche Post AG website. Using the integrated barcode, customs officials can check your shipment and electronically send the signal "Completion of exit with completion indicator". You will then receive your goods issue note in PDF form via ATLAS-Export.

Conclusion

Exporting to a non-EU country - such as Switzerland - means increased time and personnel costs for your company. This also quickly results in higher costs in general for your company. To avoid falling into a cost trap because you may have forgotten to attach the commercial invoice to the outside of the package, or generally overlook requirements and possibly have to pay penalties, it makes sense to place customs clearance in the hands of an experienced service provider.

Warehousing1 has more than 350 fulfillment partners, with whose help you can easily handle customs clearance - even for Switzerland. Are you considering bringing your product to the Swiss market? Then simply send us an inquiry via the "Start now" button. One of our account managers will get back to you within a day.